Just How Medicare Supplement Can Improve Your Insurance Protection Today

In today's complex landscape of insurance coverage options, the function of Medicare supplements stands out as a crucial component in improving one's insurance coverage. As individuals navigate the details of health care strategies and seek detailed protection, comprehending the nuances of extra insurance policy becomes significantly important. With a focus on linking the gaps left by typical Medicare plans, these extra alternatives provide a customized strategy to meeting particular demands. By exploring the benefits, protection alternatives, and cost factors to consider associated with Medicare supplements, individuals can make educated choices that not just bolster their insurance protection but likewise give a complacency for the future.

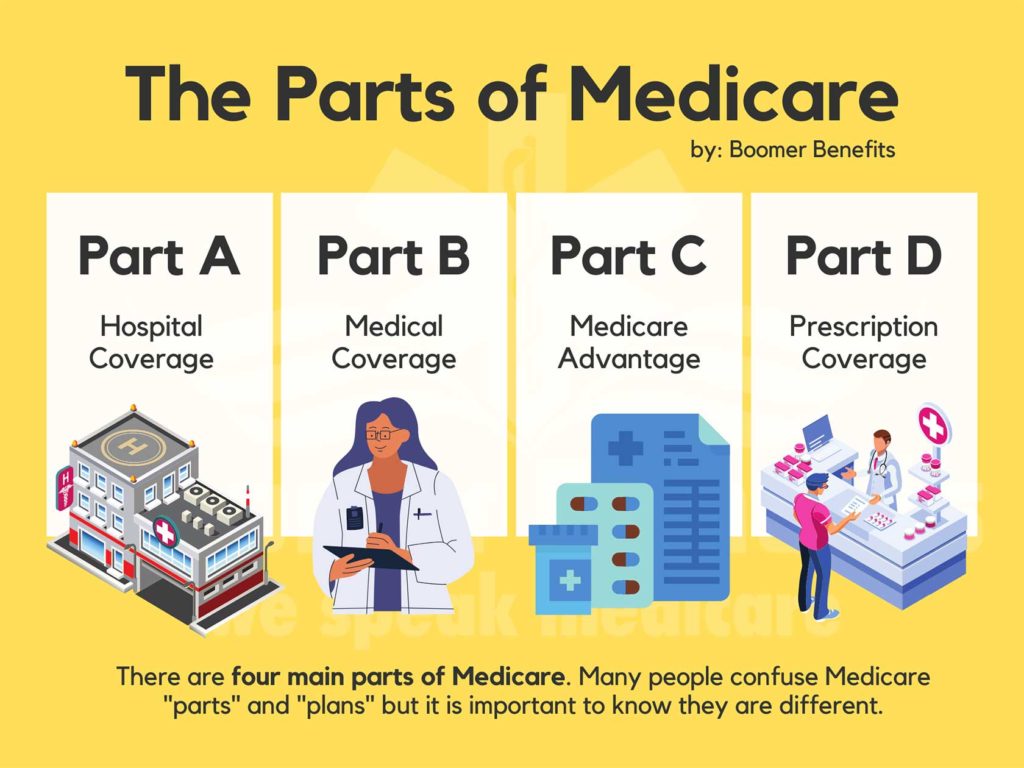

The Fundamentals of Medicare Supplements

Medicare supplements, additionally referred to as Medigap plans, offer extra insurance coverage to fill the spaces left by initial Medicare. These supplementary plans are used by exclusive insurance business and are created to cover expenditures such as copayments, coinsurance, and deductibles that are not fully covered by Medicare Part A and Part B. It's important to keep in mind that Medigap strategies can not be made use of as standalone policies but work together with original Medicare.

One secret facet of Medicare supplements is that they are standard throughout most states, providing the exact same fundamental advantages no matter of the insurance company. There are 10 various Medigap strategies classified A via N, each giving a various level of coverage. As an example, Plan F is among the most extensive choices, covering nearly all out-of-pocket prices, while various other strategies may use a lot more minimal insurance coverage at a reduced costs.

Understanding the basics of Medicare supplements is essential for individuals approaching Medicare qualification that desire to boost their insurance policy coverage and decrease potential economic worries linked with health care costs.

Understanding Insurance Coverage Options

Discovering the diverse series of protection options readily available can supply important insights right into supplementing medical care costs effectively. When considering Medicare Supplement intends, it is critical to recognize the different insurance coverage alternatives to make sure detailed insurance coverage protection. Medicare Supplement plans, also known as Medigap plans, are standardized across the majority of states and classified with letters from A to N, each offering differing degrees of protection. These strategies cover copayments, coinsurance, and deductibles that Original Medicare does not completely spend for, giving recipients with financial security and comfort. Additionally, some strategies may offer insurance coverage for solutions not included in Initial Medicare, such as emergency treatment during foreign traveling. Recognizing the coverage alternatives within each strategy type is vital for people to pick a policy that lines up with their particular healthcare needs and budget plan. By carefully analyzing the protection options available, recipients can make informed decisions to enhance their insurance coverage and efficiently take care of health care prices.

Benefits of Supplemental Program

In addition, supplemental plans offer a broader variety of protection choices, including access to health care carriers that might not approve Medicare assignment. Another advantage of supplemental strategies is the capacity to take a trip with tranquility of mind, as some strategies use insurance coverage for emergency situation clinical services while abroad. In general, the benefits of additional plans contribute to an extra thorough and customized strategy to health care protection, making sure that individuals can receive the care they require without encountering frustrating monetary problems.

Expense Considerations and Savings

Offered the monetary safety and security and broader coverage alternatives supplied by additional plans, a critical navigate to these guys facet to think about is the cost factors to consider and potential cost savings they offer. While Medicare Supplement plans call for a regular monthly premium along with the basic Medicare Part B costs, the advantages of minimized out-of-pocket costs frequently surpass the added expenditure. When evaluating the cost of supplemental strategies, it is important to contrast premiums, deductibles, copayments, and coinsurance throughout different strategy types to figure out the most cost-efficient option based on specific health care demands.

Additionally, choosing a plan that straightens with one's health and wellness and financial requirements can cause significant savings with time. By picking a Medicare Supplement plan that covers a greater percent of healthcare costs, people can minimize unforeseen costs and budget plan better for treatment. In addition, some extra strategies offer house price cuts or rewards for healthy habits, offering additional Our site possibilities for expense financial savings. Medicare Supplement plans near me. Ultimately, buying a Medicare Supplement strategy can use valuable economic protection and satisfaction for recipients seeking detailed insurance coverage.

Making the Right Option

With a variety of strategies offered, it is vital to evaluate aspects such as protection options, premiums, out-of-pocket expenses, supplier networks, and overall value. Furthermore, assessing your budget plan constraints and contrasting premium prices among various plans can assist make sure that you select a strategy that is budget friendly in the long term.

Conclusion